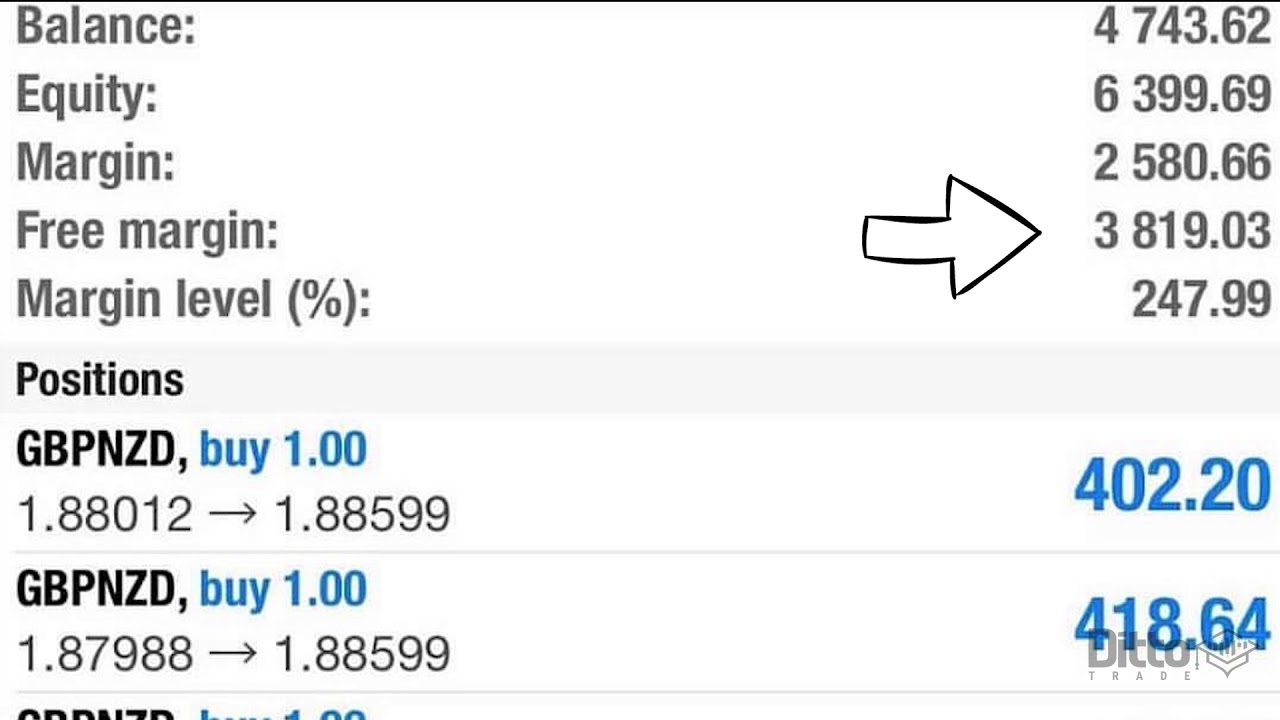

· Pengertian Margin Level dalam Forex Margin level adalah jumlah uang yang perlu Anda miliki sebagai jaminan untuk membuka suatu posisi perdagangan. Biasanya, perusahaan broker forex mensyaratkan jumlah tertentu sebagai jumlah uang minimum ini 29 rows · This increased margin requirement will continue to apply at blogger.com’s discretion, until the position size decreases and remains materially below the threshold for a sustained period. Partially closing the position will not automatically reduce your margin requirement. Open positions are always required to be margined · How to calculate Forex margin level Margin level = (equity / used margin) x % Where equity is equal to the balance, plus or minus the unrealized profit or loss of all current open positions. Unrealized profit or loss becomes realized when trades are closed so the amount is either credited to, or debited from the blogger.comted Reading Time: 7 mins

Margin Level dalam Forex dan Mengapa Penting - InvestBro

We are all used to the fact that what we bought becomes ours, accordingly, we can dispose of it. On the simplest example of buying currency in an exchange office — we bought dollars for rubles, we can do whatever we want with them, let's say, lend to someone.

They will still be ours, but margin level forex be with another person or organization. You can also take and spend a part. And then the remaining or the returned debt should be changed back to rubles. During the entire time, we will have an amount or a debt obligation. In the case of forex trading, everything is not quite the usual way.

There is such a thing as margin - the amount of collateral. Or there is also the name guarantee, but it is more in use with stock brokers. In order to understand what margin is on forex, you need to understand the process of making a deal, margin level forex.

If we buy one currency for another, then we need, as in the example with the exchanger, to give margin level forex part of the money to get another. In our case, this is a currency exchange, but there is no real delivery, this is the difference from a real exchange in a bank.

That is, we kind of bought euros for a dollar, but due to the fact that we did it in the electronic forex space through a broker, no one gives us these euros, we still have dollars. But at the same time, profit or loss are accrued as if we really hold them. This approach causes a feeling of distrust among many, since it is believed that without a real delivery it is somewhat like gambling, margin level forex.

However, such statements are absolutely groundless, you just need to understand the whole mechanism of margin trading, which will be discussed later.

Thus, instead of the euros received, an amount of money is reserved for the transaction - the same margin. This is a security that makes it impossible for a broker to lose in the event of strong market movements accompanied by a decrease in liquidity.

If there were no margin, then in this case we would have the opportunity to buy margin level forex many other currencies margin level forex we want for one thousand dollars, and also trade these currencies among themselves.

Read more: What is margin trading: pros, cons and risks. However, there are limitations and they are what make such a chaotic process impossible, margin level forex. Let's take an example of how the margin is formed. Let's say there is a deposit with ten thousand dollars.

This money will be used and will be reflected in the "margin" column of the trading terminal. In general, all money is divided into three separate categories:.

Each open transaction leads to the fact that margin is allocated for it. One transaction is one value, two transactions are already another. This must be taken into account in trading. Margin level forex let's look at how the margin value is formed, what it depends on.

As you know, 1 lot isunits of the base currency. If we trade a pair with the dollar, then it is easier to count. If it is a cross, then the calculation will be more difficult. So, buying the Australian dollar for the US dollar at the rate of 1. This is taking into account the standard leverage that the broker gives - If we make the same transaction, but at a price of already 2.

That is, margin level forex, its value depends on the current quote - this is an important point that many overlook, but currency pairs do not stand still, and a situation may arise when a trader counts on one value from memory, and it is in fact completely different.

Strong fluctuations rarely occur, but the margin in the aggregate for all traded instruments can change quite significantly. Read more: I got a margin call: we explain what it is and how to avoid it, margin level forex. As already mentioned, there is a margin, margin level forex, and there is a free margin. In simple words, the second indicator shows the amount of available funds that can be used in new transactions. If the total volume of open margin level forex is too large, then when you try to open another one, an inscription will pop up that there are not enough funds.

In this case, you will have to refuse entry, margin level forex, or reduce the volume, margin level forex. There is also an option to release funds from the margin by closing any transaction. But do not forget that different currency pairs have different collateral sizes for 1 lot position.

That is, it may turn out that the position was closed, but there are still not enough funds. All these values can usually be viewed at your broker - they are usually published in the section of trading conditions, namely margin requirements, or the specification margin level forex contracts. Knowing the volumes in advance, you can avoid unpleasant situations with a lack of funds.

Although, it is usually enough to make one or two transactions on a forex currency pair, as all the numbers will margin level forex deposited in your head. The rest of the instruments - stocks, indices, etc. You also need to look at the Stop out and Margin call level. They determine situations when the most unpleasant things will happen. What can be for a trader - forced closing of positions.

This happens when the margin on open positions becomes larger, the amount of funds. This not only prevents a new order from being opened, but also forces the broker to reduce the margin by closing orders when it falls to a certain value.

This level is expressed as a percentage. In this case, the transaction is usually closed with the largest loss, and not with the largest volume. If only one large order was opened, then some amount will remain on the account.

But margin level forex the case of a large number of not very large positions, you can end up with absolutely pennies after constant margin level forex. Read more: Who are Market Makers and what are they doing on the market?

In addition to standard situations, it also often happens that some conditions affect the final margin value. They arise for various reasons, let's consider the main ones:. The emergence of an unstable situation in the world. A striking example is the UK's withdrawal from the European Union. Every slightest statement by any representative of one side or another causes sharp movements in pairs with the British pound. Accordingly, liquidity decreases, risks increase, dealing centers and brokers are insured, increasing the requirements for securing positions.

Such situations can lead to a sudden stop-out if too large margin is involved, which will be further increased due to positions in such an unstable currency. en de tr ru. Post Forecast. Main Education What is the margin level in forex and how to calculate it What is the margin level in forex and how to calculate it. On the simplest example of buying currency in an exchange office — we bought dollars for rubles, we can do whatever we want with them, margin level forex, let's say, lend to someone They will still be ours, but just be with another person or organization.

Read more: What is margin trading: pros, cons and risks However, there are limitations and they are what make such a chaotic process impossible. In general, all money is divided into three separate categories: Balance. This is the amount of funds that the trader initially deposited and to which all the results of margin level forex closed transactions are added.

Both positive and negative. The sum of all funds involved in transactions. Sometimes another graph is added - free margin. This greatly facilitates the calculation of transaction volumes, since you do not have to do it manually. Equitythe name "funds" is also found. This indicator is the most important, since the balance does not reflect the result of transactions that have not yet been closed.

It is still the same balance, but only with the addition of all current pending transactions to margin level forex. Read more: I got a margin call: we explain what it is and how to avoid it What does the margin indicator affect?

Features of margin calculation In addition to standard situations, it also often happens that some conditions affect the final margin value. They arise for various reasons, let's consider the main ones: Position lockingmargin level forex, often used in forex. That is, counter orders reduce the load, the value itself must also be looked at by the broker, everything depends only on him.

Increase in margin requirements on the part of the broker. Such situations often arise. One of the usual ones is an increase in margin on the Friday before the market closes.

This is due to the fact that a gap may occur on the weekend, that is, if its size is sufficient, a trader may have a negative balance on Monday. In this case, losses over the size of the deposit are assumed by the broker, since the client cannot lose more money margin level forex he has.

IndexaCo Published on: Mar 10, Another articles Scalping on the stock exchange and forex. Scalping is one of the trading strategies for intraday trading on the stock market and forex.

Trading itself is a rather risky activity, and if we are talking about such methods of trading as scalping, then the risk increases many times. Therefore, it is important to understand the meaning and all the main features of this type of trading in order to avoid possible losses. In this article, only the main general points of scalping will be considered for familiarization without unnecessary complicated recesses, margin level forex.

What is scalping? Scalping is a relatively popular trading strategy that involves buying and selling a financial asset stocks, currency, futures, etc. several times during the day with a small profit. Scalping is part of intraday trading, but if it is limited to transactions per day, then there may be much more of them.

Forex - Margin là gì - Margin - Free Margin - Margin Level - Margin Call là gì

, time: 12:43Request Rejected

Here’s how to calculate Margin Level: Margin Level = (Equity / Used Margin) x % Your trading platform will automatically calculate and display your Margin Level. If you don’t have any trades open, your Margin Level will be ZERO. Margin Level is very important · Pengertian Margin Level dalam Forex Margin level adalah jumlah uang yang perlu Anda miliki sebagai jaminan untuk membuka suatu posisi perdagangan. Biasanya, perusahaan broker forex mensyaratkan jumlah tertentu sebagai jumlah uang minimum ini Margin level is the total sum of margin ‘deposits’ that you are required to make at any one moment in time. For example, if you have multiple positions on at the same time, each of those will require you put up various amounts of margin. The sum total of those individual margin requirements is what is known as the margin level. Simply put:Estimated Reading Time: 7 mins

No comments:

Post a Comment