About currency strength. To become a successful trader it is important to understand the relative strength of each currency. This indicator helps traders see which trading pairs are the strongest and which are the weakest on different time scales. With this information traders will have a great advantage on their operations /12/04 · 1) Check market strength. 2) Look for fresh moves (V Formations). 3) Identify structure priority (Legs). 4) Look for ideal S/R. 5) Estimate R:R. 6) Watch only the view chart pullback until or near the S/R (and leave a wick/tail). 7) Go down one timeframe to see if the legs are visible. 8) Enter trade accordingly to plan of blogger.comted Reading Time: 3 mins /02/17 · The currency strength index, the currency strength meter, and other currency strength indicators will directly affect your ability to determine whether a relative value change is likely to occur. The currency strength indicator can be very appealing especially for beginner traders who are still in the process of learning how to trade. This is the best currency strength

Currency Strength Indicator

Have you ever heard about currency strength indicatorssometimes also called currency strength meters? They are indicators that show the strength of individual currencies.

Here, you will learn what a currency strength indicator is, how it works and how you can integrate it in your trading. A currency strength indicator is just another sort of indicator, albeit very useful, and it is great for combining with other technical indicators. As you may know, in the Forex market, traders always work with currency pairs. But what if we want to measure the absolute strength of a currency, "disconnecting" it from a specific pair?

In other words, how can we estimate the strength of a currency in the foreign exchange market? The purpose of the currency strength indicator or a currency currency strength formula meter is to show the strength of the individual currencies in the market in order to understand which of them are the strong or getting stronger and which of them are the weak or getting weaker, currency strength formula.

There is no unique formula to estimate the strength of a currency in the market, but there are a few ways to approximate it. It is very common in this case to use other existing normalized indicators and to combine them together in order to calculate the strength of a specific currency. Then we can combine the values together with some formula to get a total or an average. Doing so for each currency, you will obtain comparable values and you can draw lines of these to make sense of which currency is stronger.

Common sub-indicators for measuring strength in comparable manner are Rate of Change and Relative Strength Index, currency strength formula.

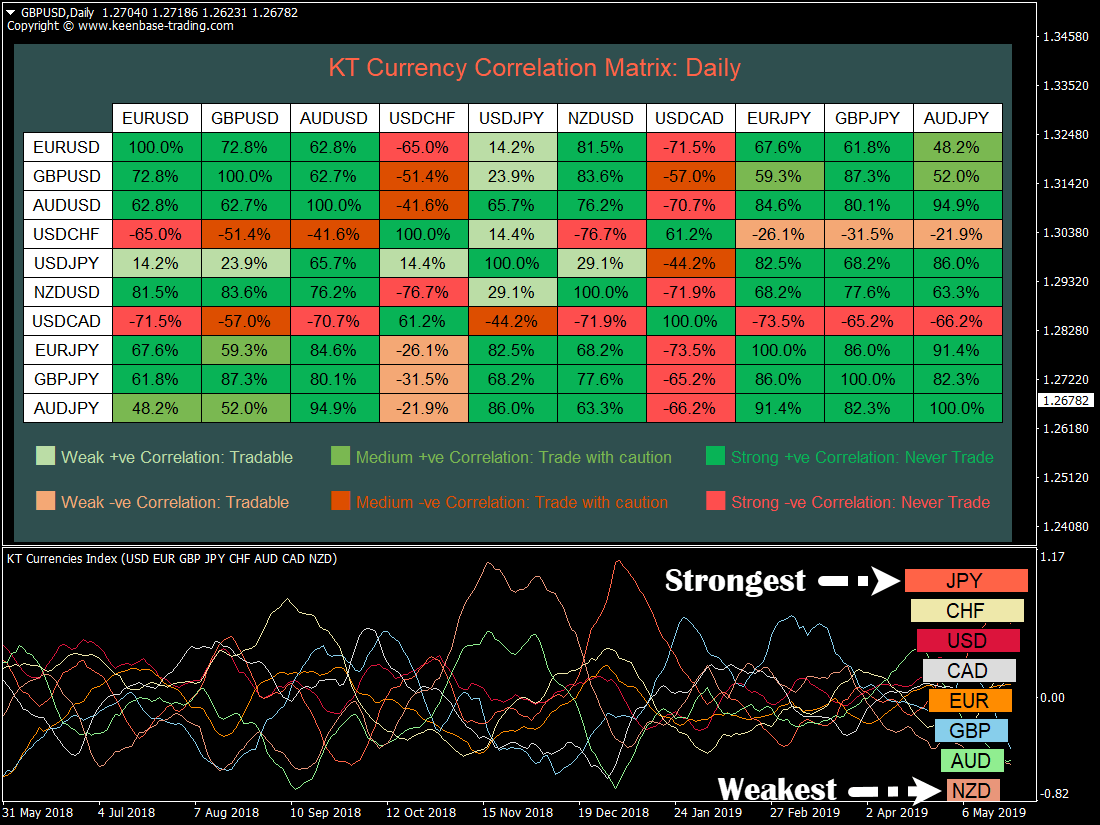

Usually, a currency strength indicator comprises lines that fluctuate around a horizontal line zero level. These lines can be smooth or rough depending on the algorithms and parameters used. Sometimes, a matrix or heatmap is used to highlight the strength of currencies across multiple timeframes in an easy-to-read form. A currency strength indicator is a very useful tool, but I recommend using it together with some other indicators or with price action in order to validate entry signals.

There are many currency strength indicators available around. There are both free and paid versions. Generally, the free ones are slow and lack configuration parameters, while the paid ones are usually quite expensive. Not being happy with what had been available to Forex traders on MetaTrader before, we developed our custom currency strength indicators that are more reliable and flexible than an average free version, yet are completely free of charge and are available for download from our website.

We let you download both the Currency Strength Lines currency strength formula and Currency Strength Matrix indicator to accommodate different trading styles, currency strength formula.

If you are new to currency strength indicators, it would be worthwhile to spend some time understanding how they work and considering their use in your trading system. A currency strength indicator can be a valuable tool to spot trading opportunities.

Instead of showing the value of a currency in relation to another currency, currency strength formula, a currency strength indicator will currency strength formula the total strength of the currency vs, currency strength formula. the entire market in a normalized way. This is achieved by calculating values in all the pairs involving a specific currency.

You can use this indicator with different trading styles. If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter. MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers Currency strength formula Cent Accounts High Leverage Forex Brokers cTrader Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter. What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service. Advertisements: EXNESS: low spreads - just excellent! Please disable AdBlock or currency strength formula EarnForex, currency strength formula.

Thank you! EarnForex Education Guides. Contents What Is Currency Strength Indicator? How Currency Strength Indicator Works? How Does Currency Strength Indicator Look Like? How to Use Currency Strength Indicator? Where to Get Currency Strength Indicators?

How to Scalp Forex trading using Finviz Currency Strength Meter- Best Forex SECRET.

, time: 18:02Currency Strength Formula - Currency Pairs - Technical Indicators - MQL5 programming forum

About currency strength. To become a successful trader it is important to understand the relative strength of each currency. This indicator helps traders see which trading pairs are the strongest and which are the weakest on different time scales. With this information traders will have a great advantage on their operations /12/04 · 1) Check market strength. 2) Look for fresh moves (V Formations). 3) Identify structure priority (Legs). 4) Look for ideal S/R. 5) Estimate R:R. 6) Watch only the view chart pullback until or near the S/R (and leave a wick/tail). 7) Go down one timeframe to see if the legs are visible. 8) Enter trade accordingly to plan of blogger.comted Reading Time: 3 mins /12/09 · shows the calculation of "Currency Strength Meter" here it is: (PIPS / [DAILY HIGH-LOW]) * BIS Weighted Formula + (PIPS / [DAILY HIGH-LOW]) * BIS Weighted Formula Then divide by Number of Pairs. it is usefull but i dont know what

No comments:

Post a Comment