The COT Indicators. The COT Indicator Suite for MetaTrader contains five indicators for displaying COT data directly onto your MetaTrader charts. This is REAL data which can be broken down to extract valuable insights as to how the large players are positioned, unlike tick volume from your broker which contains no information and is virtually Home Indicators MT4 Indicators COT By MTI This indicator uses reports by CFTC. These reports are published on the website blogger.com in two formats, “Excel” and “Text”. Select reports in text format of the category “Futures-and-Options Combined Reports”, or “Futures Only Reports”. Download five files and then rename them /10/02 · COT trading system with free indicator. 4 - If you agree, welcome. my name is Sym and I'm a trader and a coder. Time ago I felt something was missing on the web. I needed a tool for my trading decisions. For this reason I decided to code an indicator. And now this indi is going to be shared with you

Forget volume indicator: CoT indicator is for professional traders

There are many tools and information reports on the internet on which forex traders can make their trades. Some of those tools are useful enough to conveniently include in your trading strategy. One of such tools is the COT report. is an acronym for Commitment of Traders. It is a report that contains a weekly overview of how cot indicator mt4 of the futures markets in the U. have traded. The report contains all the positions of the main market factors in the United States.

The Commodity Futures Trading Commission CFTC provides this report every Friday at P. EST for all cot indicator mt4 recorded from the Tuesday of the same week to Tuesday in the previous week. As the name suggests, the COT report exposes their commitments. These major market drivers include institutional traders, hedge funds, big banks, and more, cot indicator mt4. And the weight these traders pull on the markets can sometimes be staggering enough to drive trends.

As retail forex traders, our best bet is to cot indicator mt4 like big financial institutions. A COT report will not tell you what positions any particular institutional trader is holding. Instead, it only reports a cumulative of all participants on various futures contracts. And these market participants are divided into three trading groups:. Commercial traders are big institutions who are in the futures market to hedge against risks due to unfavorable price movements that could affect their investments.

They only trade for the sake of reducing risk, not for profit. This analogy should help you understand better. Assume you own a big telecoms company in the United States. Your company imports computer chips from Japan. The Japanese chip supplier requests that you only pay them in Japanese Yen.

The value of the dollar drops against the Yen. So you devise a genius plan to offset this loss. You purchase JPY futures. This genius plan makes you a commercial trader. The story is the other way around for non-commercial traders. Non-commercial traders are large speculators who already have a lot of money in the bank, but want to make some more by trading the futures market.

Examples of these non-commercial traders include hedge funds, trading advisors, and other huge financial institutions. These institutions follow the trend unrepentantly. They buy in an uptrend and sell in a downtrend. They are speculators with smaller accounts who are also looking to make money from the futures market. Retail traders fall into this category. CFTC releases the COT reports to the public through its website. You can easily access the COT report in the following steps:. Those steps take you to the most recent weekly report.

But if you need details on past data, check the historical data section of the CFTC website. And if you need to check the weekly reports in a particular month, use the Historical Viewable section of the website. If you are going to make sense of what is before you on the report, here are some terms you must understand. Before we discuss how to trade the forex market using the COT Report, you should know why the COT Report is important for forex traders.

Forex trades are executed over-the-counter OTC. There is no central body, like NYSE, where all trades are recorded. So, it is difficult to accurately track the volumes behind all forex trades. It is also harder to know what the big banks, the large cot indicator mt4, and other market drivers, cot indicator mt4, are doing, cot indicator mt4. But with the COT report, forex traders can have an insight into these pieces of info.

The COT report can serve as a powerful forex volume indicator when you use it rightly. Since CFTC releases the weekly report every Friday for all trades recorded before Tuesday, cot indicator mt4, you can only use it for long-term trades. To use the COT Report as a volume indicator, keep your eyes on the open interest numbers of an asset.

When there is a rise in the open interest of an asset, cot indicator mt4, it means more people are trading the futures contract of the asset. To get better results, you can use the data from the COT report to complement your technical analysis from other forex trading tools. Cot indicator mt4 first method is the use of the spreads data on the report. A reversal may occur when the spread between commercial and non-commercial traders is wide. If the commercial traders are going heavily bullish while the non-commercials are heavily bearish, the market could experience a reversal to the uptrend.

And if commercials are going short while non-commercials are going long, a reversal to the downtrend may occur. The other method involves noting where the non-commercial traders are accumulating their positions.

Remember that non-commercial traders are the big money guys that are interested in making more money. They are the ones you want to mimic. So, when you find that their positions on a certain futures contract are reversing, and a reversal might be imminent on the underlying asset. This use of the COT report is similar to how you might use a sentiment indicator, such as the Current Ratio FXSSI indicatorin a forex sentiment analysis.

The image above is the COT report for the 2nd of June, Look at the NZDUSD chart around that time, cot indicator mt4. As you can see, cot indicator mt4, the currency pair just came from a downtrend and is making a reversal to the uptrend at about the same time. As we always say, never rely on one tool or indicator to decide your trades. Rather, let your tools come together to give you a trading signal. The same applies to using the COT report to trade forex.

Instead, use it in combination with your technical analysis tools to help you get the best out of it. July cot indicator mt4, Using the Commitments of Traders COT Report in Forex Trading Tips cot indicator mt4. Related Articles. What's Next? Learn basic Sentiment Strategy Setups.

Commitment of Traders Report: 80% Win Rate.

, time: 12:29COT Resources - COT Indicator Suite for MetaTrader | MT4 COT Indicator

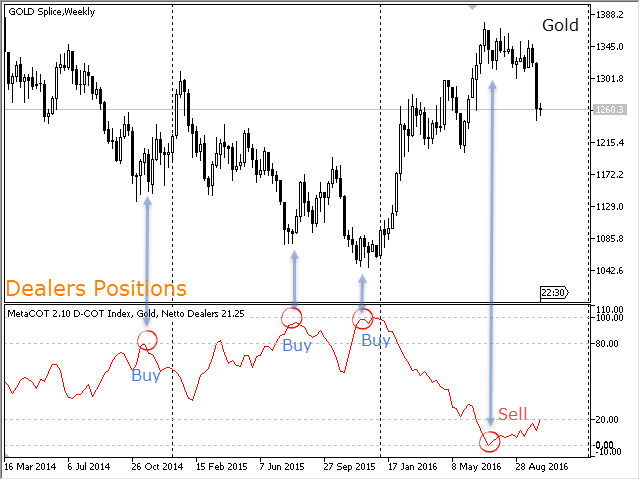

/02/22 · MetaCOT 2 is a set of indicators and specialized utilities for the analysis of the U.S. Commodity Futures Trading Commission reports. Thanks to the reports issued by the Commission, it is possible to analyze the size and direction of the positions of the major market participants, which brings the long-term price prediction accuracy to a new higher-quality level, Home Indicators MT4 Indicators COT By MTI This indicator uses reports by CFTC. These reports are published on the website blogger.com in two formats, “Excel” and “Text”. Select reports in text format of the category “Futures-and-Options Combined Reports”, or “Futures Only Reports”. Download five files and then rename them /01/26 · Previous release: CoT Data Week #41 (Speculators) Gold traders increased their net short exposure to net short $ billion. JPY/USD is a very crowded spec short trade. If risk-off sentiment increases JPY shorts will be under pressure. MXN/USD stands out as one of the few consensus spec longs against the USD

No comments:

Post a Comment