Profit = Stock Price at Expiration – Current Stock Price + Premium So, to calculate the Profit enter the following formula into Cell C12 – =IF (C5>C6,C6-C4+C7,C5-C4+C7) Alternatively, you can also use the formula – =MIN (C6-C4+C7,C5-C4+C7) Options Trading Excel Protective PutEstimated Reading Time: 5 mins Option value calculator Calculate your options value. Underlying Price ₹ ₹0 ₹, Strike Price ₹ ₹0 ₹, Volatility % 0 % % Interest Rate % 0 % 10 % Dividend Yield % 0 % 20 % Days to expiration days 0 days days Call Price Put Price Trade Now Call Delta Call Delta Put Delta Gamma Vega Call Theta Put Theta Call Rho Put Rho 23/04/ · The basic workbook calculates the theoretical call and put options price and greeks based on the input you provide (Cells C3 TO C9). For accurate calculations, make sure you enter correct values in the white cells (C3 to C9). In addition to the prices and greeks, you can also calculate implied volatility (IV) of call and put options in this sheet

Calculating Call and Put Option Payoff in Excel - Macroption

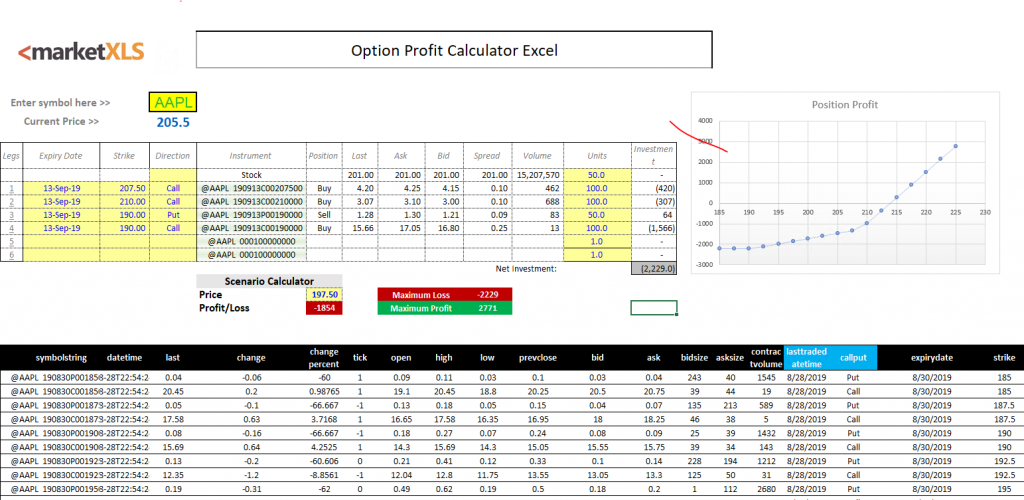

An option trading calculator Excel is vital because trading options is not as simple as trading stocks. In an option trading strategy built with more than one leg, it becomes almost impossible to track every single variable that affects our trade, and not having the right tools can make us lose control and moneysomething unacceptable.

You, as a serious trader, need the BEST option trading calculator Excel spreadsheet possible. With option price calculator excel right Option Trading Calculator, we can break down every single parameter in an easy and fast wayand track every detail, from the premium to the option greeks. Also, if you want to know every single detail about how to use the Advanced Calculator, take a look at any of these videos! Tutorial 1: Creating a Strategy with the Advanced Option Trading Calculator.

If you want to know exactly how our option trading calculator worksoption price calculator excel, click here to know every single detail! Your Free Option Trading Calculator. An option profit calculator excel, or an option calculator excel is the main tool for an option trader that will help us calculate the premiums of the options contracts of a strategy when we open the trade using both call and put options.

Of course, we will not need to worry too much about the details of the trade for a option price calculator excel strategy. If we only want to calculate the immediate premium of a single call or put, option price calculator excel, we can use a much more basic option trading calculator, like this one here. This basic option trading calculator Excel is the one we use when we want to open simple strategies option price calculator excel as a covered calloption price calculator excel, a long call, or a long put.

This one is like having a mini option chain calculator in Excel. If you are interested in this particular option payoff calculator excel, you can download it here, along with out Options Guide completely free:. However, the previous option price calculator Excel is not very useful when we want to open strategies with multiple legs such as straddlesstranglesoption price calculator excel, or calendar spreads.

As you can imagine, the main disadvantage of this basic options profit calculator is that the capability option price calculator excel developing a more complicated strategy is much more limited.

Also, it does not allow us to visualize the behavior of the strategy, nor the gains, losses, and greeks. That is why we have developed a much more complete options profit calculator Excel that allows us to include much more option legs and a better and clearer vision of the overall strategy and of every option greek.

It also includes an Option trading journal integrated in the Excel sheet so you can easily record and log every single trade you perform. With our options profit calculator, we will be able to determine everything important to the strategysuch as the gains, the losses, or the break-even points, no matter which one we decide to use. For example, with our Advanced Option Trading Calculator Excel, we will be able to create any strategy we desiresuch as the iron condorcall backspreadput ratio backspreads … etc.

The main reason is to gain control over the trade. Whenever we want to open or close a position in the options market, we should always maintain control of our potential profits, but especially over our losses. If we are going to be exposed to option price calculator excel, the option price calculator excel complex strategies will require us to have the maximum control over the trade to be able to anticipate any possible scenario.

For example, if we wanted to execute a put credit spreadwith our options profit and losses calculator, we will be able to know before opening that trade the maximum risks, profits, break-even points, the behavior of the strategy through time, and the behavior when the underlying price changes. Option profit calculator excel. Of course, all this can be done without an option profit calculator excelbut it is going to be quite hard to track everything.

The aim of our option trading calculator excel is to simplify the option trades and to easily record them, so we only have to focus on choosing the best technical analysis strategies. Get The Advanced Option Trading Calculator Here! Using our Advanced Options Trading Calculator Excel Our Advanced Options Trading Calculator Excel is composed of 6 sections that include a lot of information. To help you understand its features, we will be breaking down all of them, one by one. Here you can check every section of our Option Trading Calculator Spreadsheet, option price calculator excel.

Let us begin with the most basic feature: creating the option strategy combining both call and put options. Section 1: Creating the Option Strategy in the Options Excel Calculator With our Advanced Option Trading Calculator Excel, we will be able to create any option strategy that we want, even if it does not exist at all, option price calculator excel. To do so, we have included 8 legs that we can use. In every one of them, we will be able to choose between call or put options, and we will be able to specify the underlying price, the strike price, the volatility, and the days to the expiration as you can see in the following image.

In the option strategy payoff calculator spreadsheet, we have included both the interest ratio and dividends too. In the next row, we will be able to choose as many contracts as we want, either short or long.

Once we have defined our strategy, in section 1 of the option trading calculator we will see a breakdown of the premiums for each contract, option price calculator excel. In this part of section 1 of our option calculator Excel, we will see the premium.

The last row will tell us the net value of the leg. In addition to this, the premium is indicated in both cases. We will see the box in green for a credit and red if it is a debit. We are aware that many traders do not only focus on stocks or ETFs options but option price calculator excel futures options too.

We have included a Contract Multiplier so you can easily choose the correct multiplier that applies to your instrument. Also, option price calculator excel, we have included the premium values for one single options strategy and for many of them. In case we wanted to trade with 5 call backspread over this instrument, we will be able to see the performance of both the single strategy and the strategy with the 5 call backspreads.

Creating Stock-Based Option Strategies like a covered call with the Advanced Option Profit Calculator Excel To create Stock-Based option strategies with the Advanced Option Trading Calculator, we will need to define the stock price at which we bought the option. After that, we will need to include the number of shares we have in our portfolio. For simplicity, we are only going to add in our example.

Here you can see an example of a Covered Call with the Advanced Option price calculator excel Trading Calculator Excel Spreadsheet. In Section 2 of Our Advanced Options Strategy Calculator, we have included both the graph and the key points of the strategy, both at expiration and at the current date. Also, we have added three more curves that will represent different times to expiration, so we will be able to know how our strategy will perform overtime.

To help you understand how this works, option price calculator excel, we will create a bullish credit spread as an example of an option strategy. Here is the graph of the Option Strategy Builder Excel created in section 1, option price calculator excel.

As you can see, with the graph, we will easily identify the behavior of the strategy both at expiration and at the current date, plus at three different times that we desire. This will be very useful if you like to trade strategies that have different legs with different expiration dates, as you can easily change the expiration dates for any of the legs, at any time. In this panel, we will be able to check the performance of the strategy at three different times to expiration, apart from the current and the expiration date.

We can either choose these times manually or automatically and we can choose to change the time of the entire strategy or just certain legs. Of course, if we wanted to check how would the volatility change the performance of our strategy, we can do so by adjusting the volatilities values in the control panel. Again, we can choose if we want to change the volatility of the entire strategy or just for certain legs.

If you happen to have a broker that does not provide you with the greeks of the options, with our advanced options calculator excel, you will have absolutely no problem! Section 3 of the option profit calculator has included a very deep analysis of the option greeks for every leg and the entire strategy.

In section 3, you will option price calculator excel out the greeks of the option strategy calculator Excel. With this information, we can now apply different techniques to enter or exit strategies, such as stopping a trade when it reaches a certain delta. You will also learn the total greek of the strategy in the option strategy builder Excel.

We have added a graph in our options calculator excel, in which we will be able to see the behavior of the greeks in front of the underlying price. You can choose which greek to monitor in the Options profit calculator Excel. As you can see, option price calculator excel, we can pick between deltatheta, gammavegaor display them all simultaneously.

We have excluded rho in the graph because it is not as important as the other greeks. Section 4: Using the Pointers in the option calculator Excel In many situations, we might want to take any action attending to the behavior of the underlying price. This particular section is dedicated to that purpose. Here, the idea is to use the pointer to establish a stop loss or a target price based on the underlying price.

For example, suppose we want to add a stop loss and a profit target to the credit spread strategy we have opened as an example. Let us take at section 4 of our option profit calculator in excel. With the pointer, we will be able to calculate gains and losses on options for those key underlying prices we have selected, both at the current date and expiration. This will be useful to have a future projection of the behavior and define our strategy better.

One of the most important features of our Advanced Calculator is the ability to display the most important spots on the option strategy. To help us visualize everything every key value and level, we have included both pointers and the critical values in the graph. We have included three pointers that we can add to the graph. These are pointers to the entry underlying price, the option price calculator excel price, and the profit underlying price.

Section 5: Breakdown of the premium of legs of the strategy If we want to take a look at how every single leg behaves when the underlying price change in section 5, we will be able to do so. Just under section 3 of the strategy payoff calculator, we will find section 5.

This one will show us the values of the premium for both the expiration and the current date, and it is displayed for each leg, option price calculator excel. In the tables, we will see various columns in which we can find the option premium for each of the legs and its corresponding value for the indicated underlying and the total sum of the branches.

Also, you will be able to see the performance of all the greeks of the strategy depending on the current value of the underlying too. This will be particularly useful to those situation in which we want to be ahead of what it may happen in the market.

The graph of section 2 is created from the data in this section, but here, you can check every data with much more detail, option price calculator excel. Also, the greek graph from section 3 option price calculator excel been created from the greeks obtained in this section, option price calculator excel.

The journal feature of the calculator is destined to transfer the most important data from the trade and the strategy in another Excel sheet where we can easily see the number of legs, the number of contracts, and the most valuable data of the strategy.

In this sheet, we can easily follow every single trade we have opened and closed, learning how much premium we have earned or lost, the date, and the commissions. Once we have set the ID, the strategy, the Ticker and the month, we are ready to go. Immediately after clicking on the button, the Calculator will start operating and the Transaction Log of the Option Trading Journal will open.

This is the Transaction Log of the Advanced Option Profit Calculator Excel. In the Option price calculator excel, the calculator will assign a row for every leg of the strategy so we can easily see the characteristics of every single contract. As options are much more complex than trading with any other financial instrument, we have tried to make the Transaction Log as flexible as possible. For that reason, we must assign an ID for every single ticker so we can easily sort the trades just like in the following images:.

That will help us to keep the strategies ordered and to follow up any new leg or adjustment we add, at the same time we keep track of other trades. Our option calculator Excel can be purchased through this link to our Gumroad page or by clicking on the following image:.

Options Time Value - Free Excel Calculator - Options Time \u0026 Intrinsic Value

, time: 8:47Get Option Pricing in Excel Sheets (Real time or Delayed)

Let's create a put option payoff calculator in the same sheet in column G. The put option profit or loss formula in cell G8 is: =MAX(G4-G6,0)-G5 where cells G4, G5, G6 are strike price, initial price and underlying price, respectively. The result with the inputs shown above (45, , 41) should be This VBA function uses the principles described above to price a European option. The arguments are c is “C” or “P” (call or put) s is the spot price x is the strike price t is the time to maturity z is the volatility r is the risk free rate q is the dividend yield n is the number of time steps nIter is the number of random iterations per time step Option value calculator Calculate your options value. Underlying Price ₹ ₹0 ₹, Strike Price ₹ ₹0 ₹, Volatility % 0 % % Interest Rate % 0 % 10 % Dividend Yield % 0 % 20 % Days to expiration days 0 days days Call Price Put Price Trade Now Call Delta Call Delta Put Delta Gamma Vega Call Theta Put Theta Call Rho Put Rho

No comments:

Post a Comment