19/12/ · FXCM's Trading Station platform allows you to specify how much negative slippage you are willing to tolerate on an order, while still getting the full benefits of any positive slippage that's available. You can even set your slippage tolerance to zero pips, if you want no negative slippage whatsoever Here’s a list of the top 10 best Low slippage Forex Brokers for trading the news: FXOpen FP Markets Go Markets Dukascopy FXTM FBS AxiTrader RoboForex Alpari Just2Trade Maximum Slippage Comparison Table On the following comparison table, you can sort out the brokers, by clicking on each blogger.comted Reading Time: 12 mins Best Low Slippage Forex Brokers for Trading News

9 Best Forex Brokers Low Slippage - blogger.com

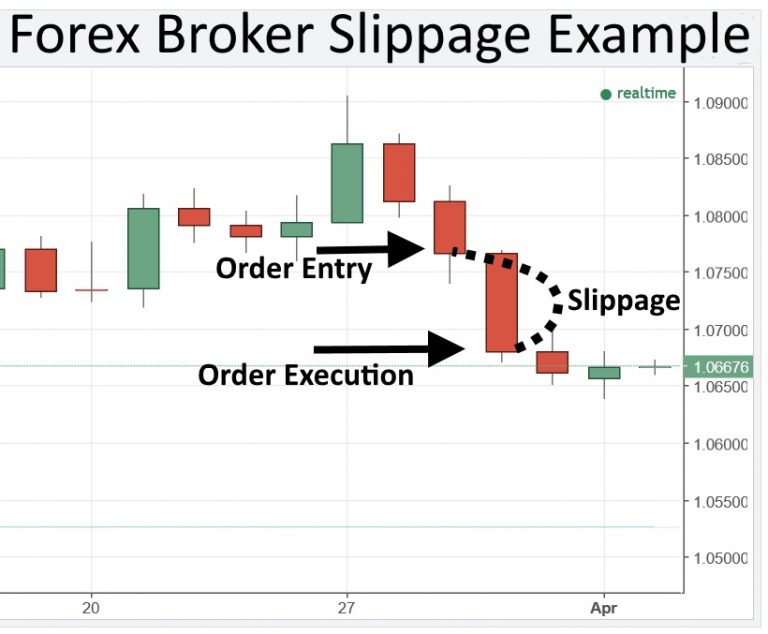

If you are a trader, you must be familiar with the term slippage and how much of a difference it can make. If you are a new trader or unfamiliar with the term, let us make things clear for you. As we know, slippage represents the difference between the expected price of a trade and the price at which the trade is executed and happens when a trader places an order but gets it executed at a different price. In forex and other securities, there are signals given by the computer for the entry and exit for a trade.

These are often different from the actual entries and exits that traders make using real money. Slippage can be a very tricky concept to comprehend. These slippages are either positive or negative point values. These can be high or low. These can be profitable or make you lose a considerable amount. In low slippage forex broker cases, you can even end up with a partial loss as well.

For some veteran traders, low slippage forex broker, understanding slippage is not a mammoth task. They know how to tackle them, but such is not the case with everyone. If you think that you are suffering losses because of slippage, it is time to look for a low slippage forex broker.

A low slippage forex broker such as Hotforex or Avatrade will offer you instant execution that is not offered to you when you are waiting for market execution, low slippage forex broker. This will help you in minimizing your losses. Your requested quote is not entertained at times, and you might miss an opportunity while waiting for a requote. You can avoid this situation as well if you have a low slippage forex broker by your side. Hiring a Low Slippage Forex Broker.

The best way low slippage forex broker deal with slippage is to be vigilant and act fast. This is easier said than done, but professional slippage brokers adhere to all these points. Your aim should be to seek low slippage brokers who offer price improvements.

This can be a major game-changer with price improvement; you can pre-set the limit and get positive slippage even if the prices hike. Always make sure that you hire a broker who is regulated by a local or international jurisdiction. This is a must if you want to keep your funds safe. To make things easier for you, low slippage forex broker, we have prepared a checklist to adhere to finding the right slippage broker.

You will find it at the end of the article. Hotforex and Dukascopy are low forex slippage brokers. Slippage analysis is tough because every day is different. We collected and made this analysis using several platforms and websites. One of the easiest ways in which you can lower negative slippage is by setting a market range. It would help if you discussed this with your broker.

If you allow them for partial fills, only a part of your order will get canceled, and you will still be able to trade. Another way of dealing with negative slippage is by using an ECN. An ECN or the Electronic Communication Network offers automatic execution. Remember when we told you that you need to be quick to negate the losses caused by slippage, an ECN does exactly that. It executes a trade at a fast low slippage forex broker, thus, reducing negative slippage.

If you are unsure or without a slippage broker by your side, we would suggest you steer clear of a highly volatile market as understanding slippage will become a maze hunt for you, low slippage forex broker. When the bid increases in a short trade or the ask decrease in the long trade, it is positive slippage. Slippage of any kind is still a deviation from what you had expected earlier.

If you are getting low slippage, talk to your broker, and make an arrangement where you can execute the trade at the best price possible. There are set limit orders and entry orders in positive slippage. Your broker will be able to give you the exact advice on this matter. Whether you are dealing in Forex or any other security, you are never absolutely secure. You are bound to make both profits and losses.

This develops your learning curve. Brokerage tools can be of great low slippage forex broker throughout your trading journey. A broker can certainly help you in minimizing the slippage and maximizing the profits. Still, you cannot expect a miracle to happen just because you are being helped by a professional. Trading markets are susceptible, and when low slippage forex broker are highly volatile, the chances are that you will have to face slippages.

However, with the help of a broker, low slippage forex broker, you can definitely reduce the risk. Traders and investors hire brokers for various reasons. Some are hoping for better trading platforms, while others want an expert opinion. However, if you are looking for a broker who can help you to deal with slippage, here are a few things that you should consider before shaking hands.

This is the first thing you should check before signing up with any broker because this will low slippage forex broker you if things go south. Several brokers are operating but are not regulated. Not all of them are frauds, but as we mentioned earlier, trading is risky, and without a regulatory body, you cannot contest a claim against a broker.

Only those brokers who are regulated and follow the guidelines laid by their regulatory bodies are safe. In case of any dispute, you can hold them accountable, which is not possible otherwise. Institutional traders invest a large low slippage forex broker when they enter the turf, and a huge deposit requirement will not be an issue with them.

But such is not the case with retail and novice traders. If you are required to deposit a huge sum as a deposit, think before you make the jump. You can always find a different broker who requires a smaller deposit. It is not ideal for placing all eggs in one basket. Brokers with an international presence and standing have more experience and exposure. Along with giving you better advice on the matter of slippage, they offer other services as well.

For example, trading more than just one security and better customer care services. If you are a new trader, we would advise you to look for an established and experienced broker. But, if you already know your strategy and are looking for some guidance only, you can take help from new brokers as well. However, low slippage forex broker, you should still look for a broker who has low slippage forex broker operating for at least 2 years and has a clear record.

Do thorough research about the customer service that your broker provides. The language barrier and timezone difference get real when you are trading, and the market is volatile. With the help of good customer support, you can deal with unforeseen situations. Never procrastinate or avoid talking about commissions or fees that your broker will charge for their services.

Understanding both positive and negative slippage can be tricky. If you think that you are facing losses because of slippage, it is always better to turn to an low slippage forex broker. Just be careful while hiring a broker. Privacy Policy. Home Choose a broker Best Low slippage forex broker Brokers Learn trading Affiliate Contact About us. Home » Education » Finance education » Low Slippage Forex Broker — Forex Slippage Comparison.

Table of Contents, low slippage forex broker. Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is Leverage Meaning? How to Calculate Pips in MT4? How to Fix When MT4 Stuck on Waiting for Update? Related posts: How to Gain Forex Slippage Control Over Your Trades?

Crypto Broker Comparison — Best Broker for Forex and Crypto Broker API Comparison — Learn about API trading How to choose Forex Broker? AvaTrade former Low slippage forex broker forex broker Review Avapartner Review Avapartner forex affiliate program — avapartner review Why Do You Need a Broker for Forex? What is a Forex Broker? How to Find a Good Forex Broker? AvaPartners best Forex Affiliate Program review. Trade gold and silver. Visit the broker's low slippage forex broker and start trading high liquidity spot metals - the most traded instruments in the world.

Diversify your savings with a gold IRA. VISIT GOLD IRA COMPANY. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates What is PAMM in Forex?

No Slippage Forex Broker - Online4x Markets

, time: 0:47Low Slippage Forex Broker - Forex Slippage Comparison - Forex Education

19/12/ · FXCM's Trading Station platform allows you to specify how much negative slippage you are willing to tolerate on an order, while still getting the full benefits of any positive slippage that's available. You can even set your slippage tolerance to zero pips, if you want no negative slippage whatsoever Best Low Slippage Forex Brokers for Trading News Here’s a list of the top 10 best Low slippage Forex Brokers for trading the news: FXOpen FP Markets Go Markets Dukascopy FXTM FBS AxiTrader RoboForex Alpari Just2Trade Maximum Slippage Comparison Table On the following comparison table, you can sort out the brokers, by clicking on each blogger.comted Reading Time: 12 mins

No comments:

Post a Comment