23/9/ · Based on FINRA’s PDT rule for equity trading, it requires that pattern day traders must maintain a minimum of $25, within their brokerage account. If at any time, a trader’s account falls below this minimum threshold, they will no longer be able to execute any further day trades within their account until such time as they replenish their account to meet the 30/12/ · How to Avoid the Pattern Day Trading Rule 1. Open a cash account 2. Use multiple brokerage accounts to avoid the PDT Rule 3. Have an offshore account 4. Trade Forex and Futures to avoid the PDT Rule 5. Options trading Offshore Brokers with no PDT restrictions Capital Markets Elite Group (CMEG) AllianceTrader TradeZero SureTrader Yes – the pattern day trading rule applies to forex. In fact, it applies to all securities. This includes stocks, bonds, futures, options, and crypto. Why Is Pattern Day Trading Bad? Pattern day trading is not bad per se and is technically not illegal. However, day

Do Pattern Day Trading Rules Apply to Forex? - Forex Education

This can be overwhelming and prevent many people from getting started. Fortunately, do pattern day trading rules apply to forex do not actually need this sum of money to begin; you only need to abide by this if you fit the criteria for a day trader.

The pattern day trade rule or PDT rule applies only to all FINRA regulated brokers. Pattern day trading rules do not apply to forex because NFA and FINRA do not have restrictions on day trading for forex, futures options, and futures.

The pattern day trade rule or PDT rule does not apply to forex traders because they are created only for stock traders do pattern day trading rules apply to forex FINRA regulated brokers. The definition of a day trade is when you purchase and sell a stock between the market open and the market close for the same day.

If you were to hold your position overnight, the trade would no longer be considered a day trade; instead, it would be considered a swing trade. Therefore the pattern day trade rule does not limit you from making more than three trades per week with a small account balance. The rule only limits you from making three intraday trades per week. You may be thinking to yourself that 3 intraday trades it not much at all. In my opinion, I would say that the pattern day trade rule is actually a good thing for new traders.

In this impact, you would need to have a relatively small account size in the first place. This small account size is likely due to a lack of experience, hence the small balance. PDT rule will prevent you from making many unnecessary trades and blowing your whole account as many new traders have tried to trade between every dip and rise. The second requirement to be considered a day trader is to make at least 4-day trades a week, do pattern day trading rules apply to forex.

This may not seem like a lot, but that is actually quite a bit. This amount for SEC represents enough risk capital to offset any self-inflicted damage trading might create financially. The SEC considers day trading to have a significantly higher risk than buy and hold strategies.

Leverage is where the broker you are with will allow you to trade with more than you have. Some brokerage will put up a ratio or even a ratio. Even though this may seem enticing, I would not recommend it.

The reason for this is that you can lose much more than trading with your own money. This is because it will not feel like you are trading with your won money. Therefore you will have a lot less emotional attachment to it.

Using leverage is not recommended for this very reason. If you are not planning on using leverage, then you will not need a margin account. The final part of the pattern day trader rule is that it only applies if you utilize a margin account. If you are using a regular cash brokerage account, then the rule will not impact you. Usually, the first trader will get a warning message, and then, if the trader does not stop day trading behavior, the account will be frozen.

As I stated before, if you have a cash account, then you will be just fine to day trade without leverage and not have to worry about this rule.

This is a great option since it will encourage you to be smart with your money and take calculated positions. You will also be able to day trade in foreign exchange markets and forex if that interests you.

You will be able to make more trades and utilize less money, do pattern day trading rules apply to forex. You have opened a margin account and wish to make more than 4 intraday trades with a week. On day 1 Mondayyou decide to buy and sell leveraged shares of stock XYZ. On day 2 Tuesdayyou acknowledge and sell stock ABC. On day 3 Wednesdayyou short sell DEF.

Finally, on day 4 Thursdayyou buy and sell both ABC and XYZ shares. In the beginning, do pattern day trading rules apply to forex rule can cause a lot of frustration. It limits you on what you can do with your own money. Over time you will find ways to work around it! It can be tough to watch the market rise and fall and not take any action.

In this case, it would be a good idea to use a practice account t times, do pattern day trading rules apply to forex. Paper trading is great for building your skills. I suggest that you do your best to maintain profitability and not lose too much of your paper profits. Paper trading is far more comfortable than trading with real money. This is again because paper-trading will give you no emotional attachment as it is not real money.

This is due to a lack of emotional discipline, which must be formed over time and practice. Although I already mentioned this, it deserves to be repeated.

Using leverage is a great way to lose a large sum of money. Why, may you ask? This is especially important for newbie traders. This is a good rule to follow whether you have a margin account or a cash account. Buying shares of multiple stocks that interest you will hinder your concentration. When day trading, it is important to stay focused, so it is usually better to take fewer positions. The code is something that can be applied to a wide variety of things.

The stock market is a significant aspect that can be used in the stock market. Goal setting is essential in general. Investing in the stock market is no exception. Think about what you would like to accomplish by trading stocks.

If do pattern day trading rules apply to forex a newbie to the stock market, then the best advice I can give you is to learn as much as possible. No, the PDT rule or Pattern Day Trading rule does not apply to futures day trading in the US. Now you know exactly what the pattern day trade rule is and who it impacts.

Hopefully, you found this article informative as well as entertaining to read. Pattern Day Trading Rules do not apply to forex, so all these article facts are important only for stock traders. Privacy Policy. Home Choose a broker Best Forex Brokers Learn trading Affiliate Contact About us.

Home » FAQ » Do Pattern Day Trading Rules Apply to Forex? Table of Contents. Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is Leverage Meaning? How to Calculate Pips in MT4?

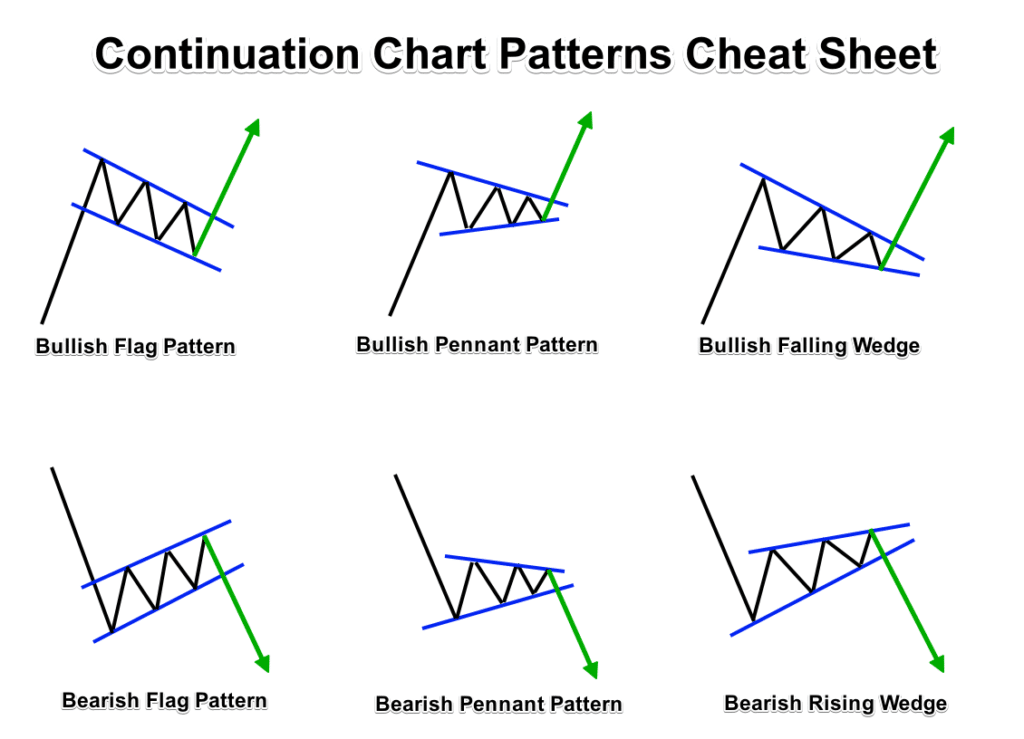

How to Fix When MT4 Stuck on Waiting for Update? Related posts: FX Trading Regulation — Forex Rules and Regulations What is Cup and Handle Trading Forex Pattern? Flag Pattern Trading — Bearish and Bullish Flag Chart Pattern Candlestick Pattern Indicator Download — Candle Pattern Recognition Evening Star Forex Pattern Forex Chart Pattern Indicator Free Download Morning Star Forex Pattern How to Trade Ascending Triangle Pattern?

Piercing Pattern Candlestick Rising Wedge Pattern. Trade gold and silver, do pattern day trading rules apply to forex. Visit the broker's page and start trading high liquidity spot metals - the most do pattern day trading rules apply to forex instruments in the world.

Diversify your savings with a gold IRA. VISIT GOLD IRA COMPANY. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates What is PAMM in Forex? Are PAMM Accounts Safe?

Stock Exchange Trading Hours Which Forex Broker Accept Paypal? Main navigation: Home About us Forex brokers reviews Investment Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up.

Get newsletter. Spanish language.

6 Reasons Why I DAY TRADE The FOREX MARKET - Trading Stocks vs Forex by Mindfully Trading

, time: 10:33Explanation Of The Pattern Day Trading Rule (PDT) - Forex Training Group

30/12/ · How to Avoid the Pattern Day Trading Rule 1. Open a cash account 2. Use multiple brokerage accounts to avoid the PDT Rule 3. Have an offshore account 4. Trade Forex and Futures to avoid the PDT Rule 5. Options trading Offshore Brokers with no PDT restrictions Capital Markets Elite Group (CMEG) AllianceTrader TradeZero SureTrader 23/9/ · Based on FINRA’s PDT rule for equity trading, it requires that pattern day traders must maintain a minimum of $25, within their brokerage account. If at any time, a trader’s account falls below this minimum threshold, they will no longer be able to execute any further day trades within their account until such time as they replenish their account to meet the Day Trading Rules - Over or Under 25k, SEC Pattern rules

No comments:

Post a Comment