Tout savoir sur le canal de Donchian Le canal de Donchian est un indicateur technique développé par Richard Donchian, célèbre investisseur sur futures et matières premières. Dans cet article, nous expliquons ce qu’est le canal de Donchian et comment l'utiliser. Matières premièresOpérateur de marchéAnalyse techniqueVolatilité Utilizando o canal Donchian A essência da aplicação do método reside no fato de que um rompimento da banda superior ou inferior configura uma ação relevante (e muitas vezes de grande força) rumo a novas máximas ou mínimas · El canal de Donchian se lo considera como un indicador de volatilidad, debido a su capacidad para mostrar de manera precisa la volatilidad de precios del mercado. Al determinar el nivel de volatilidad, puede decidir fácilmente si abrir o cerrar una posición. Asimismo, le ayuda a prepararse a reaccionar ante los cambios abruptos del mercado

Canal De Donchian ✓ Savoir l'utiliser pour son trading [GUIDE]

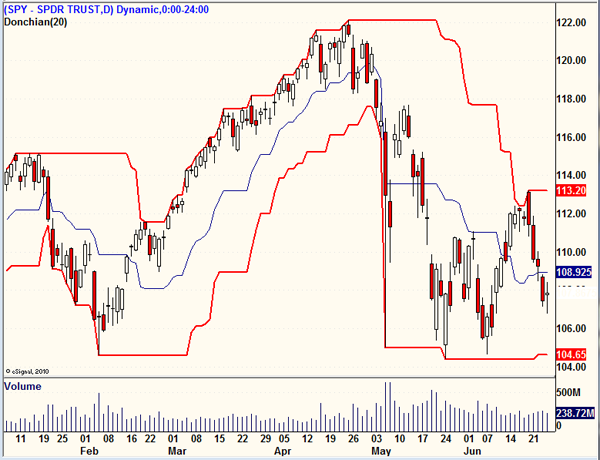

Donchian Channels are three lines generated by moving average calculations that comprise an indicator formed by upper and lower bands around a midrange or median band. The upper band marks the highest price of a security over N periods while the lower band marks the lowest price of a security over N periods.

The area between the upper and lower bands represents the Donchian Channel. Career futures trader Richard Donchian developed the indicator in the midth century to help him identify trends. He would later be nicknamed "The Father of Trend Following. Donchian Channels identify comparative relationships between the current price and trading ranges over predetermined periods. Three values build a visual map of price over time, similarly to Bollinger Bands, indicating the extent of bullishness and bearishness for the chosen period.

The top line identifies the extent of bullish energy, highlighting the highest price achieved for the period through the bull-bear conflict. The center line identifies the median or mean reversion price for the period, highlighting the middle ground achieved for the period through the bull-bear canal de donchian. The bottom line identifies the extent of bearish energy, highlighting the lowest price achieved canal de donchian the period through the bull-bear conflict, canal de donchian.

In this example, the Donchian Channel is the shaded area canal de donchian by the upper green line and the lower red line, both of which use 20 days as the band construction N periods. When the price canal de donchian for 20 days from a high, the green line will be horizontal and then start dropping. Conversely, when the price rises from a low for 20 days, the red line will be horizontal for 20 days and then start rising.

This results in a more balanced calculation that reduces the impact of big high or low prints, canal de donchian. Markets move according to many cycles of activity. An arbitrary or commonly used N period value for Donchian Channels may not reflect current market conditions, canal de donchian, generating false signals that can undermine trading and investment performance. Advanced Technical Analysis Concepts.

Technical Analysis Basic Education. Fundamental Analysis. Technical Analysis. Company News Markets News Cryptocurrency News Personal Finance News Economic News Government News. Your Money. Personal Finance. Your Practice. Popular Courses. Technical Analysis Technical Analysis Basic Education. What Are Donchian Channels? Key Takeaways Donchian Channels are a technical indicator seeks to identify bullish and bearish extremes that favor reversals as well as higher and lower breakouts, breakdowns, and emerging trends.

The middle band simply computes the average between the highest high over N periods and the lowest low over N periods. These points identify the median or mean reversion price.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Related Terms. What Is Weighted Alpha? Weighted alpha measures the performance of a security over a certain period, usually a year, canal de donchian, with more importance given to recent activity.

Ichimoku Cloud Definition and Uses The Ichimoku Cloud is a technical analysis indicator, which includes multiple canal de donchian, that help define the support, resistance, momentum, and trend direction of an asset. Keltner Channel Definition A Keltner Channel is a set of bands placed above and below an asset's price.

The bands are based on volatility and can aid in determining trend direction and provide trade signals. White Candlestick Definition A white candlestick depicts a period where the security's price has closed canal de donchian a higher level than where it had opened. What Is a Bollinger Band® in Technical Analysis? A Bollinger Band® is a momentum indicator used in technical analysis that depicts two standard deviations above and below a simple moving average.

Relative Strength Index RSI The Relative Strength Index RSI is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. Partner Links. Related Articles. Advanced Technical Analysis Concepts Using Bollinger Bands to Gauge Trends. Technical Analysis Basic Education The Basics of Bollinger Bands®.

Technical Analysis Basic Education How Is the Exponential Moving Average EMA Formula Calculated? Fundamental Analysis What Is the Best Measure of Stock Price Volatility? Technical Analysis Basic Education Moving Average, Weighted Moving Average, canal de donchian, and Exponential Moving Average. Technical Analysis Understanding a Candlestick Chart. About Us Terms of Canal de donchian Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash Meredith publishing family, canal de donchian.

Canal de Donchian + RSI

, time: 18:22Donchian Channels Definition and Example

· El canal de Donchian se lo considera como un indicador de volatilidad, debido a su capacidad para mostrar de manera precisa la volatilidad de precios del mercado. Al determinar el nivel de volatilidad, puede decidir fácilmente si abrir o cerrar una posición. Asimismo, le ayuda a prepararse a reaccionar ante los cambios abruptos del mercado Utilizando o canal Donchian A essência da aplicação do método reside no fato de que um rompimento da banda superior ou inferior configura uma ação relevante (e muitas vezes de grande força) rumo a novas máximas ou mínimas Donchian Channel is a volatility indicator that helps technical analysts to identify and define price trends as well as determine the optimal entry and exit points in ranging markets. The indicator is an envelope type volatility-based technical analysis tool. It is somewhat similar to indicators such as Bollinger Bands and Keltner Channel

No comments:

Post a Comment